April 2025

Understanding the Tariffs

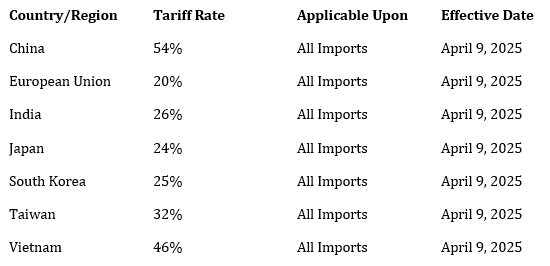

On April 5, 2025, the United States imposed a blanket 10% tariff on all exports to USA. This was followed by country-specific reciprocal tariffs intended to offset what the U.S. perceives as unfair trade barriers imposed by major exporting countries.

Table 1: U.S. Reciprocal Tariff Rates Imposed on Major Exporting Countries

The above mentioned reciprocal tariffs are imposed on major exporting countries, which will be imposed upon the blanket tariff, increasing exporting costs for those countries with an aim to reduce the export deficit of USA.

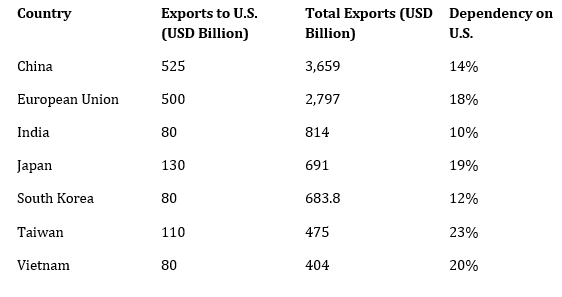

Well it is important to understand, how much of exports of such nations are catered to USA, in order to assess the risk tariffs hold for the above nations.

Table 2: Export Dependency on the United States (2024)

As evident, the export dependency of some countries on specific states is significant and cannot be overlooked—accounting for approximately 20% of their total exports in some cases. The United States, being the world’s largest importer with imports valued at around USD 3,170 billion, is a critical trade partner for many of these nations.

In response to various trade policies and tariffs, some countries like China have retaliated by imposing tariffs on imports from such nations. Initially, even the European Union had implemented tariffs on several U.S. products but later revoked them.

Let’s now examine whether any of the mentioned countries have taken further measures and whether those steps could escalate trade tensions.

Table 3: Retaliatory Measures by Affected Countries

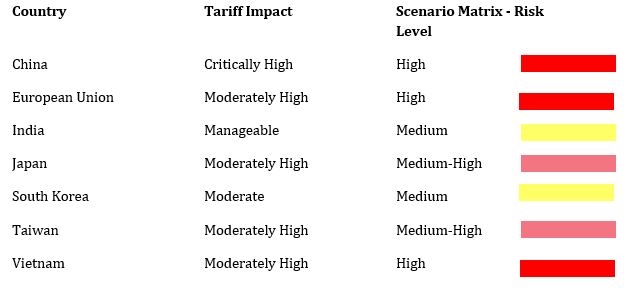

It is essential to know the type of risks above mentioned countries would carry trading with USA, so as to scope out for countries which may have trade tensions with USA.

Table 4: Scenario Matrix – Trade Risk Assessment

Impact Upon India

Now that We have examined the global stand of countries after the blanket & reciprocal tariffs were imposed by the USA, let us look forward toward the impact of them in the Indian Economy.

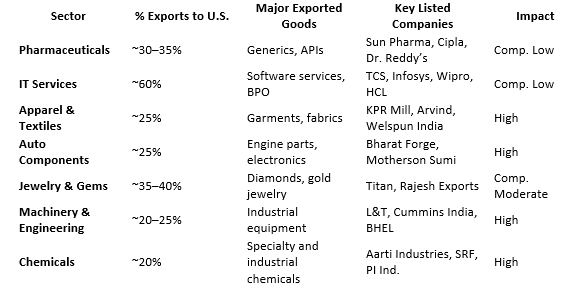

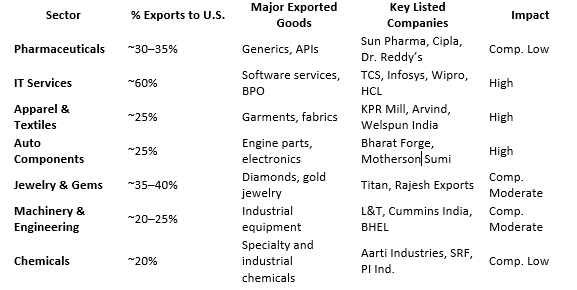

The Tariff will Impact Many business but Majorly the Retail, Manufacturing & Logistics are exposed to the direct risks of tariffs, Let us Understand it by further analyzing the Impacted sectors.

Table 5: Indian Sectors Impacted

➤ Direct Tariff Risk

If the U.S. places or raises tariffs on Indian goods (e.g., steel, textiles), costs go up → competitiveness goes down.

Affected: Textiles, Chemicals, Auto components.

➤ Indirect Risk

If Chinese goods face higher tariffs and are diverted to India (global oversupply), local prices drop.

Affected: Metals, Electronics, Machinery

➤ Pressure Points:

Auto Ancillaries (Motherson Sumi, Bharat Forge): U.S. clients may reduce sourcing due to cost inflation.

Textiles (Welspun, Trident): Margin compression if tariffs imposed on finished goods.

Chemicals: U.S.-China re-routing may lead to price wars.

➤ Resilience / Opportunity:

Pharma: Medicines are essential, not luxury items. Even with tariffs, people and governments still need to buy them.

Jewelry: U.S. remains a strong luxury buyer; gold volatility may benefit hedged players.

Conclusion:

As India awaits further clarity in its trade negotiations with the United States, one significant opportunity stands out — expanding its export base by capturing the market share that China stands to lose due to escalating trade tensions with the U.S. The current environment resembles a “fog of war” scenario, marked by uncertainty and rapid shifts in global trade dynamics.

The United States has recently announced a broad set of tariff increases on Chinese imports, particularly in strategic sectors such as electric vehicles, semiconductors, batteries, solar cells, and critical minerals. These tariffs, some rising to as much as 100% on EVs, are aimed at countering overcapacity and unfair trade practices. This policy shift could indirectly benefit countries like India, which can position themselves as alternative suppliers in select sectors.

India holds a relative competitive advantage in the face of these reciprocal and universal tariffs, especially given the blanket 10% tariff and sector-specific hikes. While all exporting nations will feel some impact, the U.S. remains the world’s largest importer, making it a market that cannot be ignored.

However, in the short term, Indian exporters are likely to face pressure. Operational margins of shrimp and seafood exporters, chemical producers, automobile and auto-ancillary companies are expected to contract. For example:

- Automobile exporters to USA are subject to a 25% tariff, and certain auto parts will also face a 15-25% tariff.

- Solar companies like Waaree, which rely significantly on U.S. markets, will see margin compression.

- Pharmaceutical exporters may also experience a hit, though the sector could see long-term gains as Chinese competition recedes.

Exporters in chemicals, pharmaceuticals, and industrial goods will face near-term headwinds, but also have a medium- to long-term opportunity to gain ground as Chinese exports lose share in these categories.

It’s important to note that these new tariffs are focused on product-based sectors. Service exports, particularly in IT and business services, are expected to see minimal direct impact. Similarly, domestically focused companies or those without significant U.S. export exposure will be better positioned to sustain their operational performance.