1. Players in the Power Sector

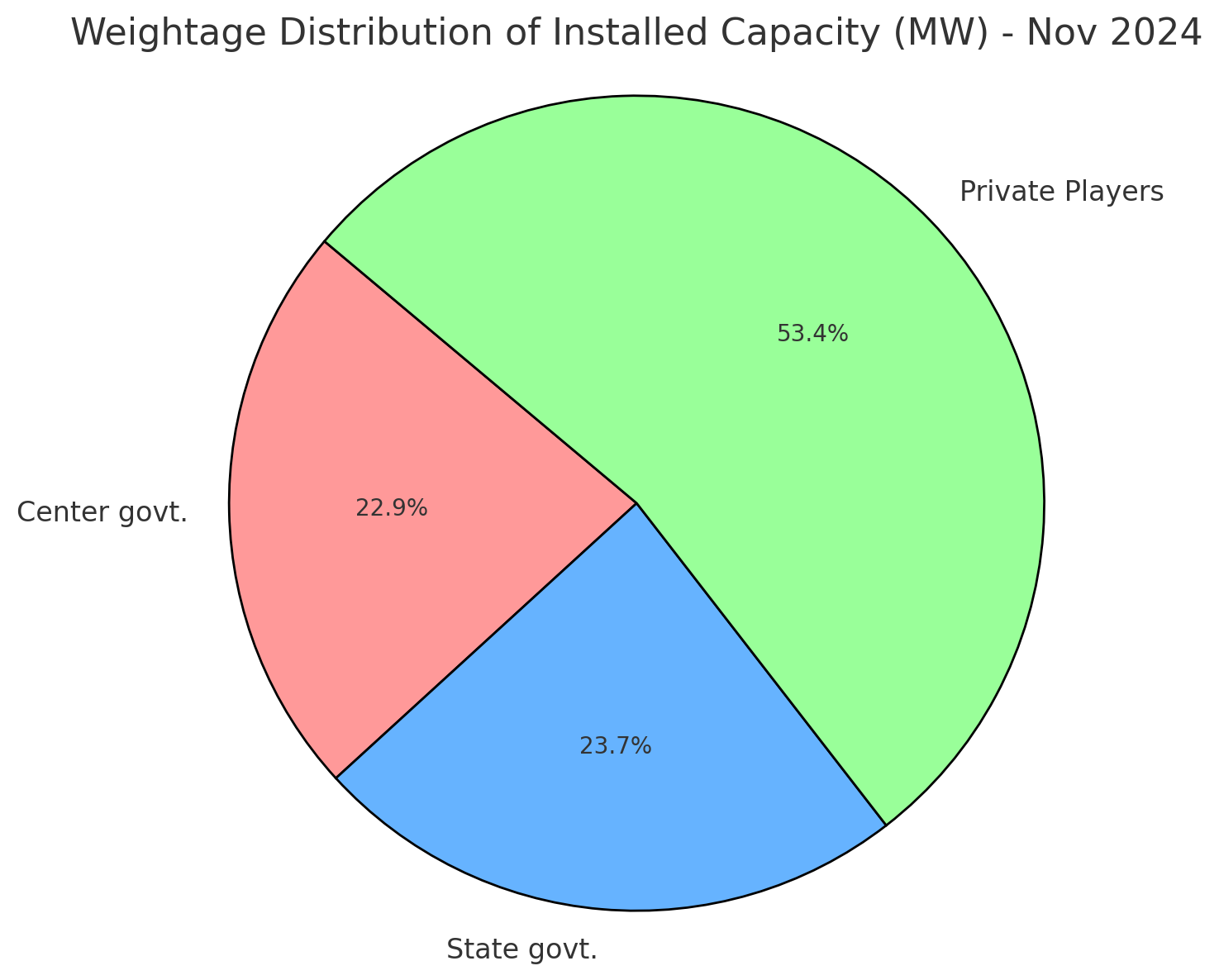

India’s power sector is a mix of public, private, and state-owned entities, each contributing to the country’s energy landscape.

The government plays a pivotal role in energy policy-making and providing infrastructure, while the private sector has been increasingly involved in generating, transmitting, and distributing electricity.

The growth of the renewable energy sector, alongside the modernization of thermal and hydro plants, has allowed various players to emerge in the market.

On the basis of major ownership stake owned, there are 2 types of player in this sector:

- PSU (Public Sector Undertaking) Players: Wherein 51% of the ownership stake is owned by Government entities.

- Private Players: Wherein 51% of the ownership stake is owned by private entities.

2.Understanding the source behind the energy

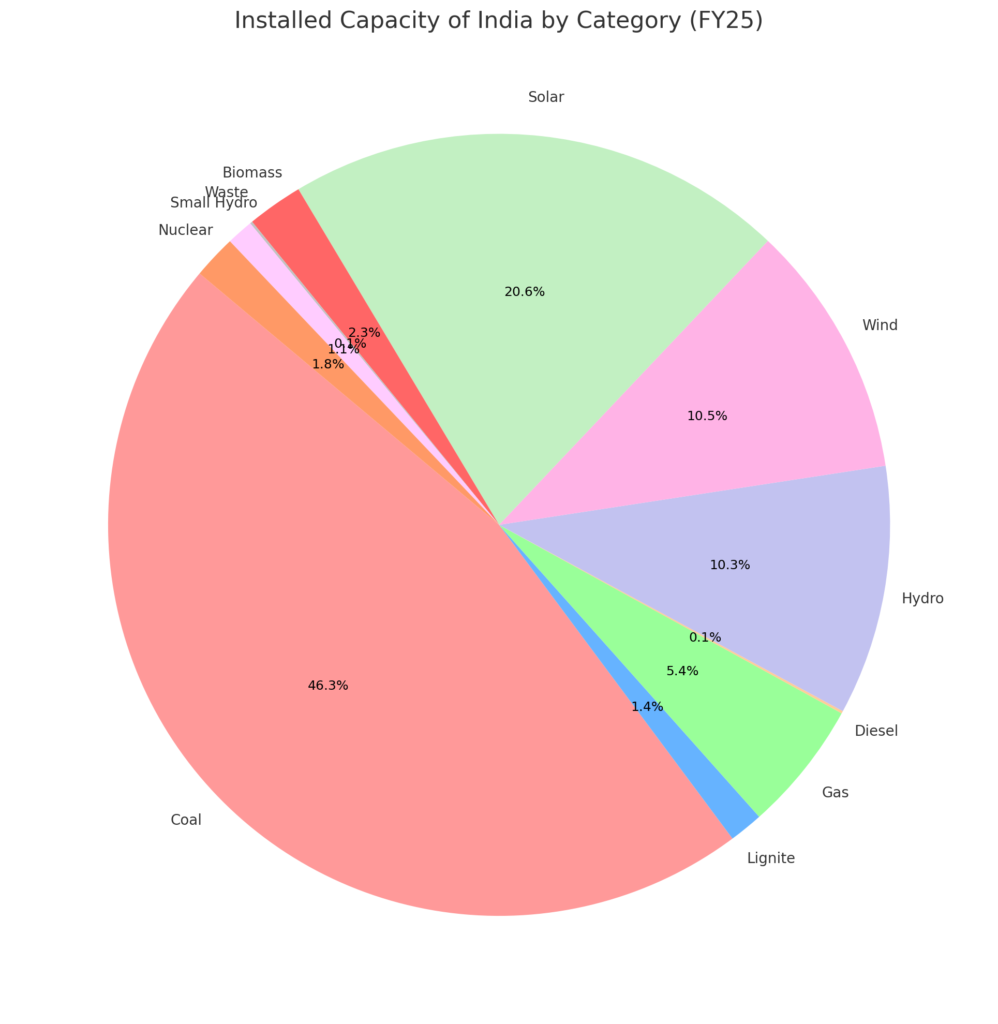

Energy is produced through various sources in India, the major stake of energy being produced from coal alone which is 46.2% of India’s energy derived from coal.

Fossil fuel based Sources contribute 53.2% of electricity generated in India, whereas the Renewable Energy from Non Conventional sources contributes 45% & Nuclear 1.8%, showcasing India’s current landscape of energy being derived from.

| Category | Installed Capacity (GW) | Weightage in Total Capacity (%) |

| Conventional (Fossil Fuel) – Coal | 211.03 | 46.2 |

| Conventional (Fossil Fuel) – Lignite | 6.62 | 1.4 |

| Conventional (Fossil Fuel) – Gas | 24.818 | 5.4 |

| Conventional (Fossil Fuel) – Diesel | 0.589 | 0.1 |

| Total Fossil Fuel Capacity | 243.057 | 53.2 |

| Non-Conventional (RES incl. Hydro) | 205.521 | 45 |

| Non-Conventional – Hydro | 46.968 | 10.3 |

| Non-Conventional – Wind, Solar & Other RE | 158.552 | 34.7 |

| Non-Conventional – Wind | 47.959 | 10.5 |

| Non-Conventional – Solar | 94.168 | 20.6 |

| Non-Conventional – Biomass Power/Cogeneration | 10.728 | 2.3 |

| Non-Conventional – Waste to Energy | 0.613 | 0.1 |

| Non-Conventional – Small Hydro Power | 5.084 | 1.1 |

| Nuclear | 8.18 | 1.8 |

| Total Non-Fossil Fuel Capacity | 213.701 | 46.8 |

| Total Installed Capacity of India (Nov24/FY25) | 456.758 | 100 |

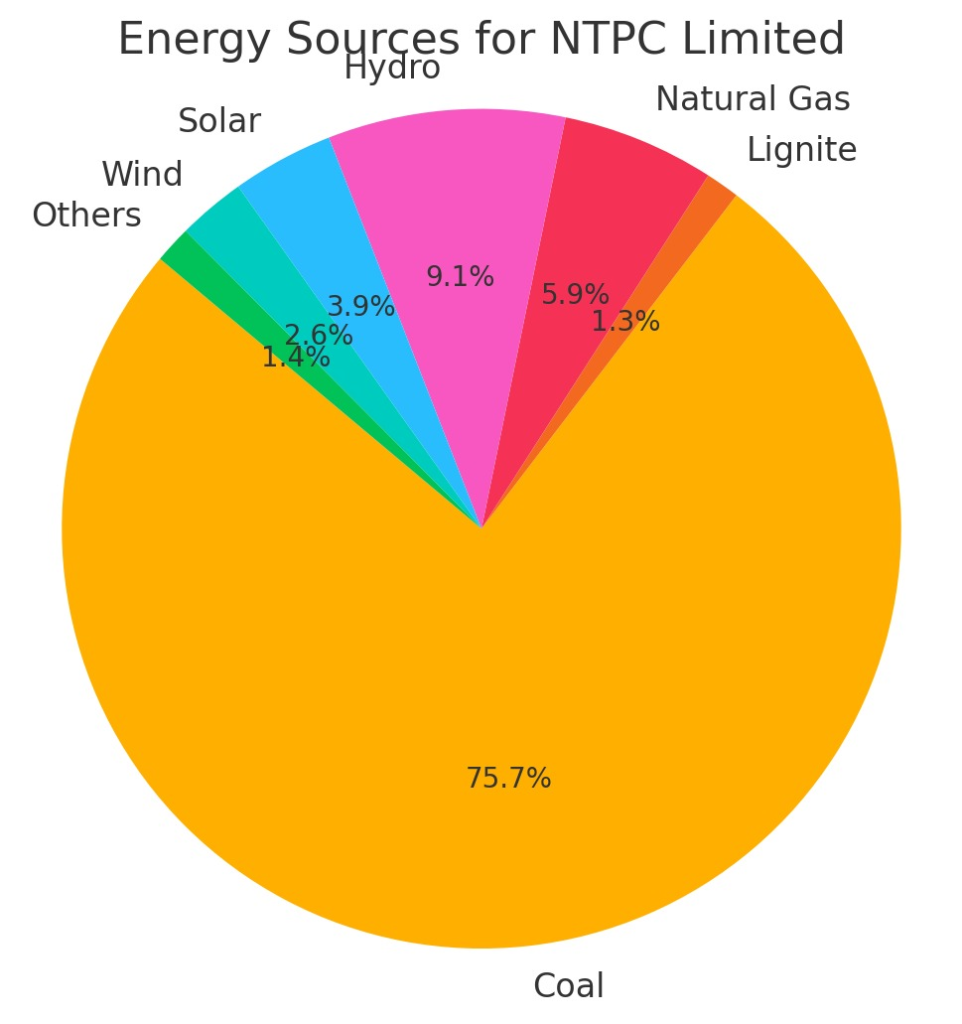

There are various market participants (companies) that contribute to the installed capacity of such sources.

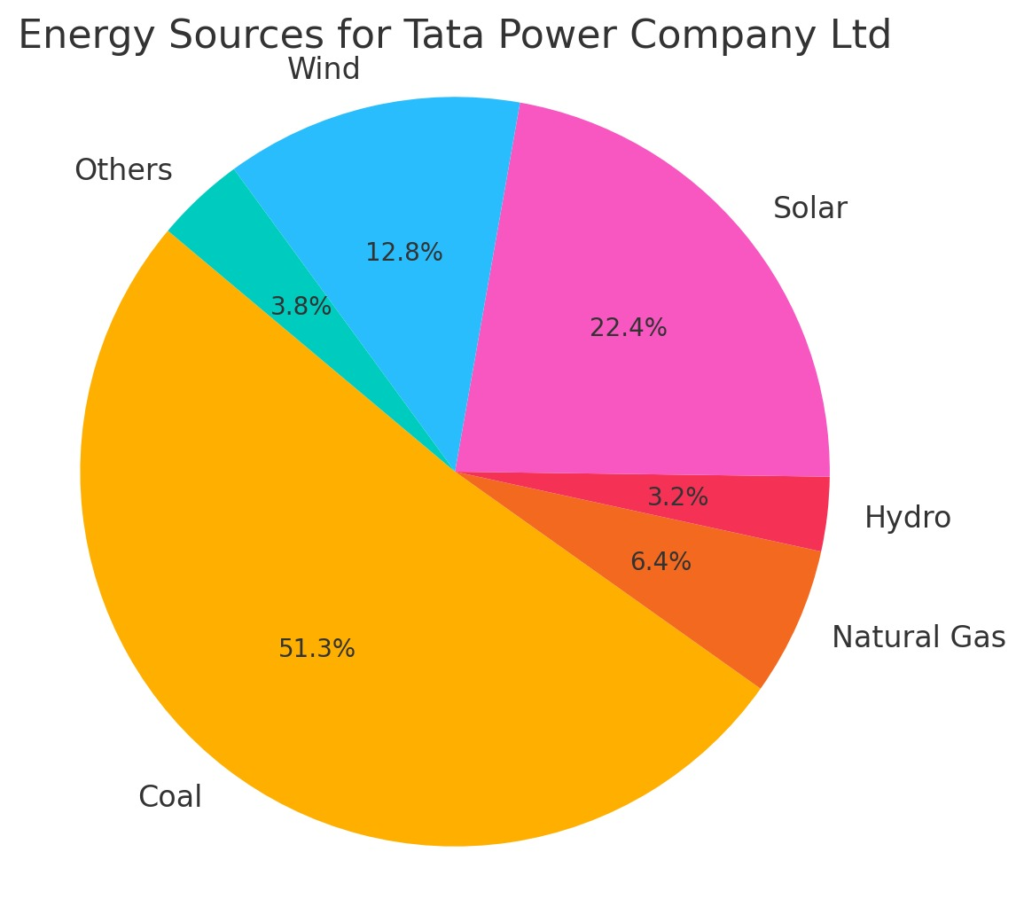

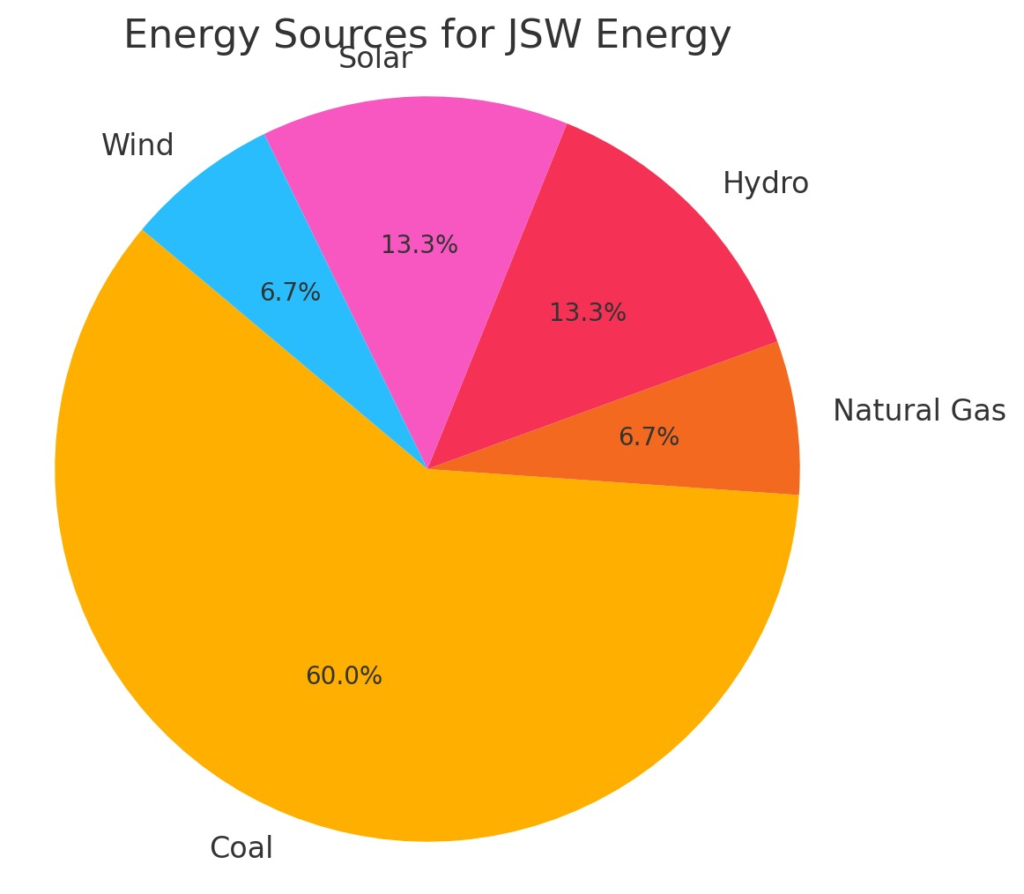

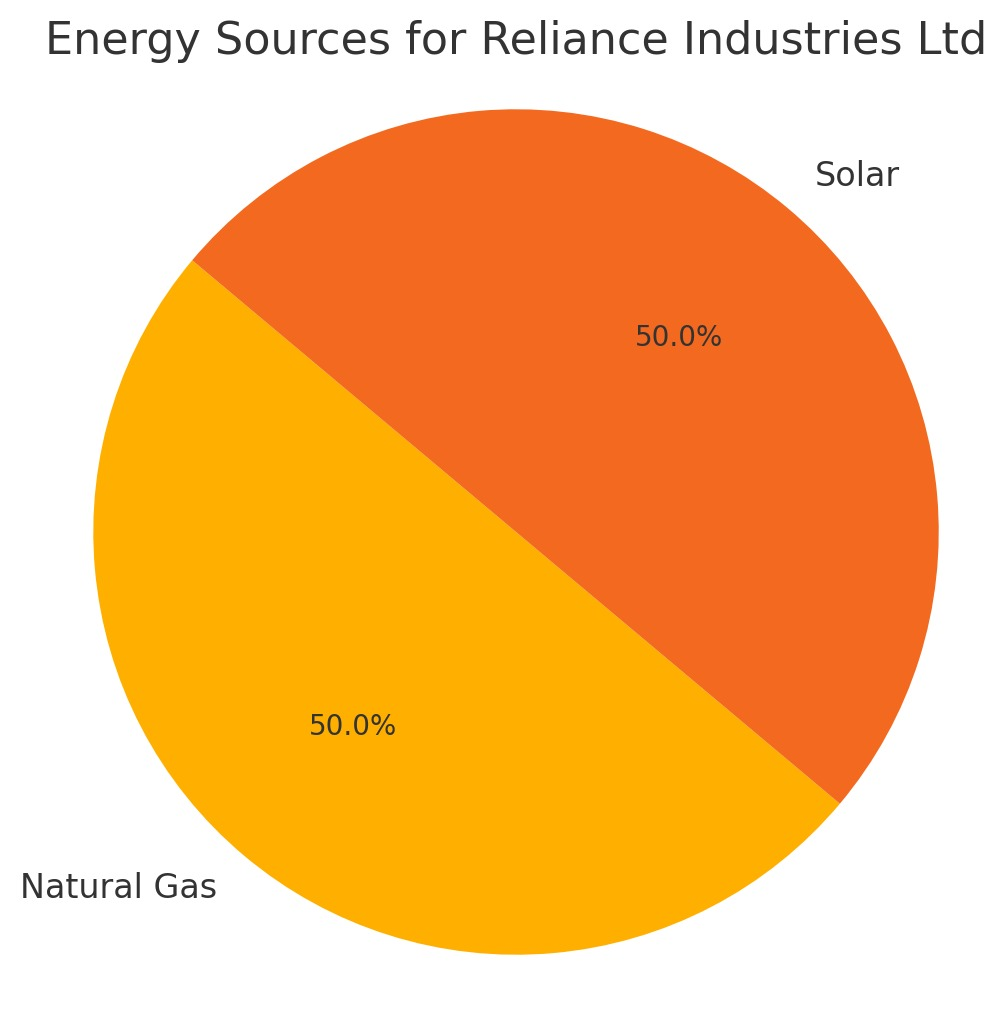

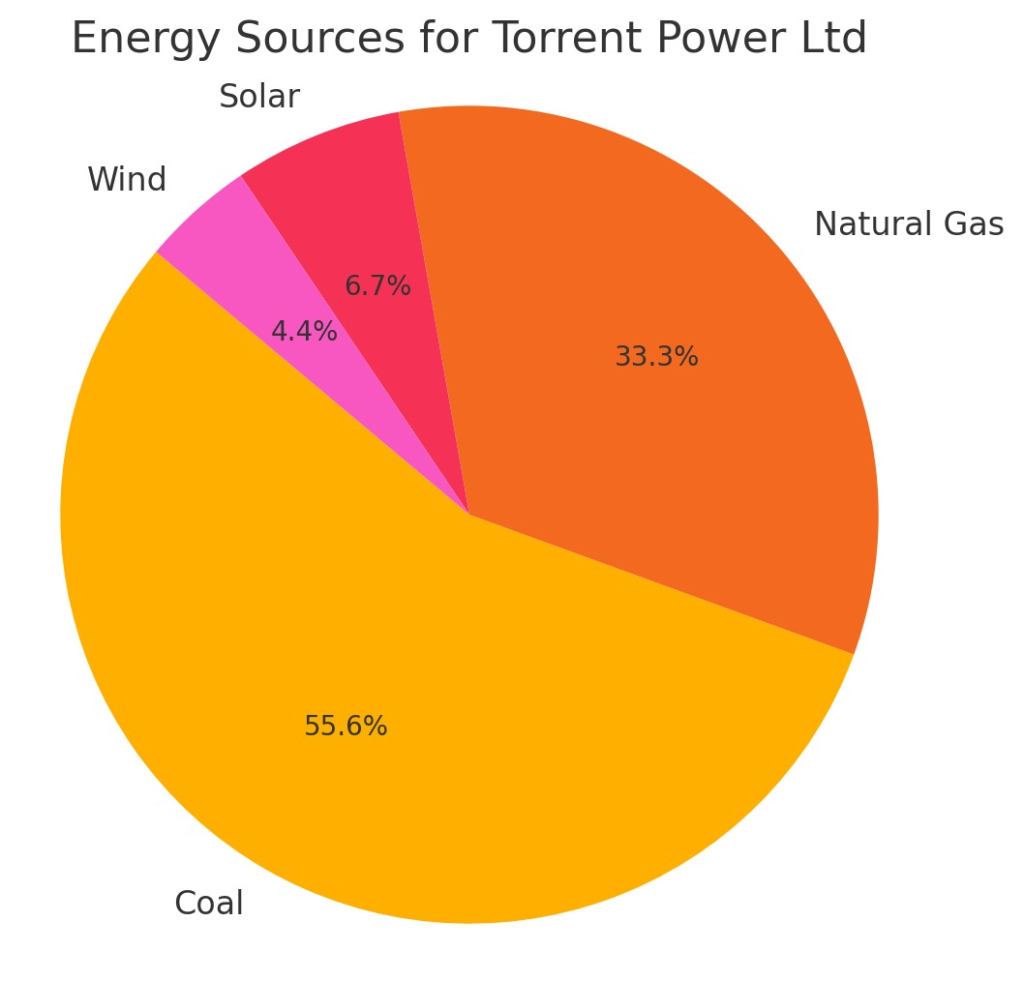

The core of the power sector is the generation of energy, let us check out some examples with a break-up of their installed capacity.

3. Types of businesses involved in Power Generation

Companies derive energy from various sources, but these entities differ on a specific segment.

There are 2 types of businesses involved in the generation of energy in India:

- A pure-play company in the power sector focuses exclusively on one type of energy production or service, such as a solar power company that solely derives revenue from energy .generation.

When a news specifically hits the energy sector, much market-price risk is witnessed in such case as risk & reward are centered in 1 sector. - A conglomerate company in the power sector operates across multiple energy segments and derives revenue from various segments of the economy and not just energy generation.

A news impacting the energy sector does affect the business but the risk & rewards are diversified across various sectors of economy hence market-price risk is relatively less intense here.

Major Pure-Play Companies involved in Power Generation:

The above listed companies being a pure-play company showcases a change in Market-price if a news targeting energy sector is released.

Major Conglomerates involved in Power Generation:

The above listed companies being a conglomerate, have presence in various other sectors, hence any news impacting energy sector will affect them but the positives/negatives of the other sectors will diversify the market-price risk.

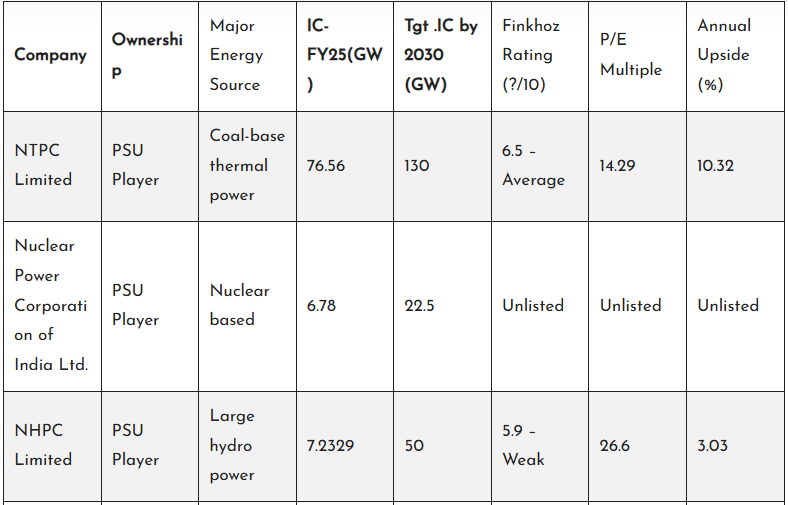

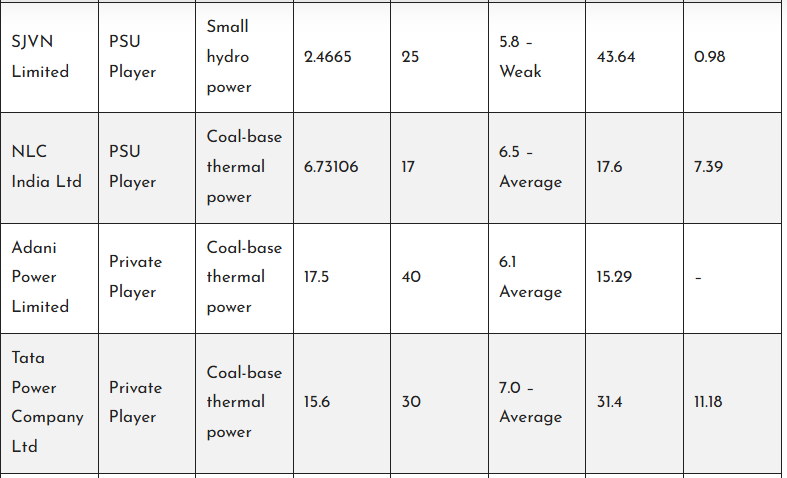

3.1 About the above mentioned companies

To grasp a better view of the companies stated above, know their performance & know more about their business, visit Finkhoz!

To evaluate the performance of such companies it becomes quite essential to know the capital costs involved for such projects of the companies.

4.Capital Cost per MW in Solar, Thermal, Wind, etc.

The capital cost for generating electricity varies significantly based on the technology and energy source. Here’s a general breakdown of capital costs per MW for different power generation sources:

- Solar Power:

- Capital cost: ₹3.5 to ₹5 crore per MW

- Solar energy is one of the most cost-effective forms of renewable energy in India, thanks to falling module costs and government incentives.

- Thermal Power:

- Capital cost: ₹6 to ₹8 crore per MW (Coal-based)

- The capital cost for thermal power plants is higher due to the need for extensive infrastructure, fuel procurement, and environmental compliance measures.

- Wind Power:

- Capital cost: ₹5 to ₹7 crore per MW

- Wind power, while more expensive than solar, has seen a decline in cost over the years due to technological advancements in turbine efficiency and scale of installation.

- Hydropower:

- Capital cost: ₹6 to ₹10 crore per MW

- Hydropower is capital-intensive due to the large-scale infrastructure required, including dam construction and transmission lines.

- Battery Storage:

- Capital cost: ₹8 to ₹12 crore per MW

- Battery storage systems, which are essential for stabilizing the grid with renewable sources like solar and wind, are still expensive but are expected to become more affordable as technology matures.

If the above information is clubbed with a company’s future targets, it provides us a pathway to understand the future prospects of such companies.

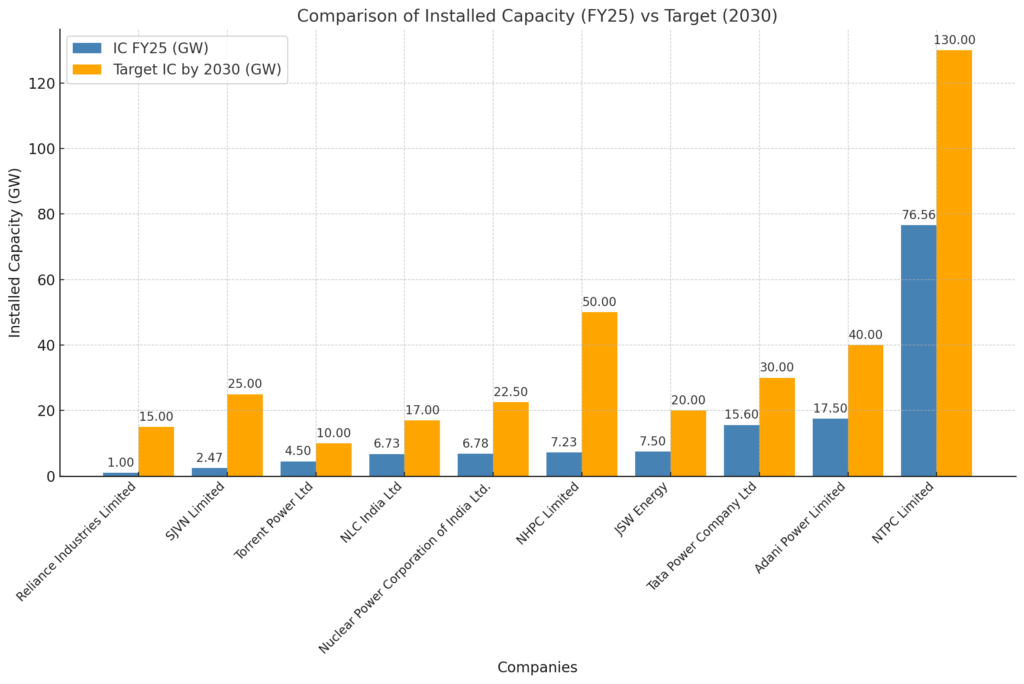

5.Major Players’ Future Targets

- NTPC Limited: NTPC has set an ambitious target to achieve 60 GW of renewable energy capacity by 2032 as part of its transition towards a cleaner energy mix with a total of 130 GW. The company plans to diversify its portfolio by adding solar, wind, and hybrid energy sources.

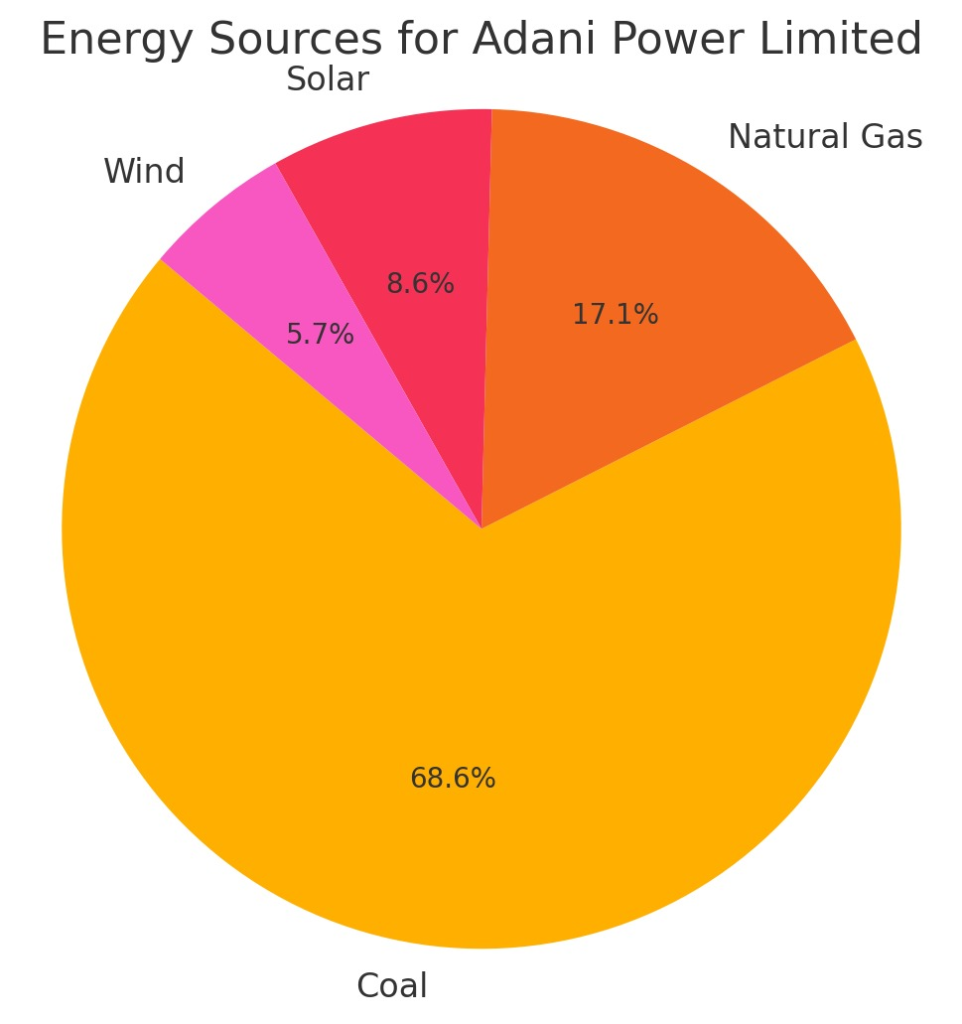

- Adani Power: Adani has committed to achieving 25 GW of renewable energy capacity by 2025 and40 GW by 2030. It aims to diversify its portfolio into solar and wind energy to reduce its dependence on thermal generation.

- Tata Power: Tata Power aims to expand its renewable capacity to 20 GW by 2030 and 32 GW of total capacity installed, with a significant focus on solar energy. It also plans to strengthen its position in the electric vehicle (EV) charging infrastructure.

- Reliance Industries: Reliance has also announced specific projects, including a plan to set up 10 GW of renewable energy capacity in Uttar Pradesh and an additional 5 GW through various initiatives across the country.

- JSW Energy: JSW Energy has outlined a target to achieve 20 GW of renewable energy capacity by 2030, with a focus on wind and solar energy.

Conclusion

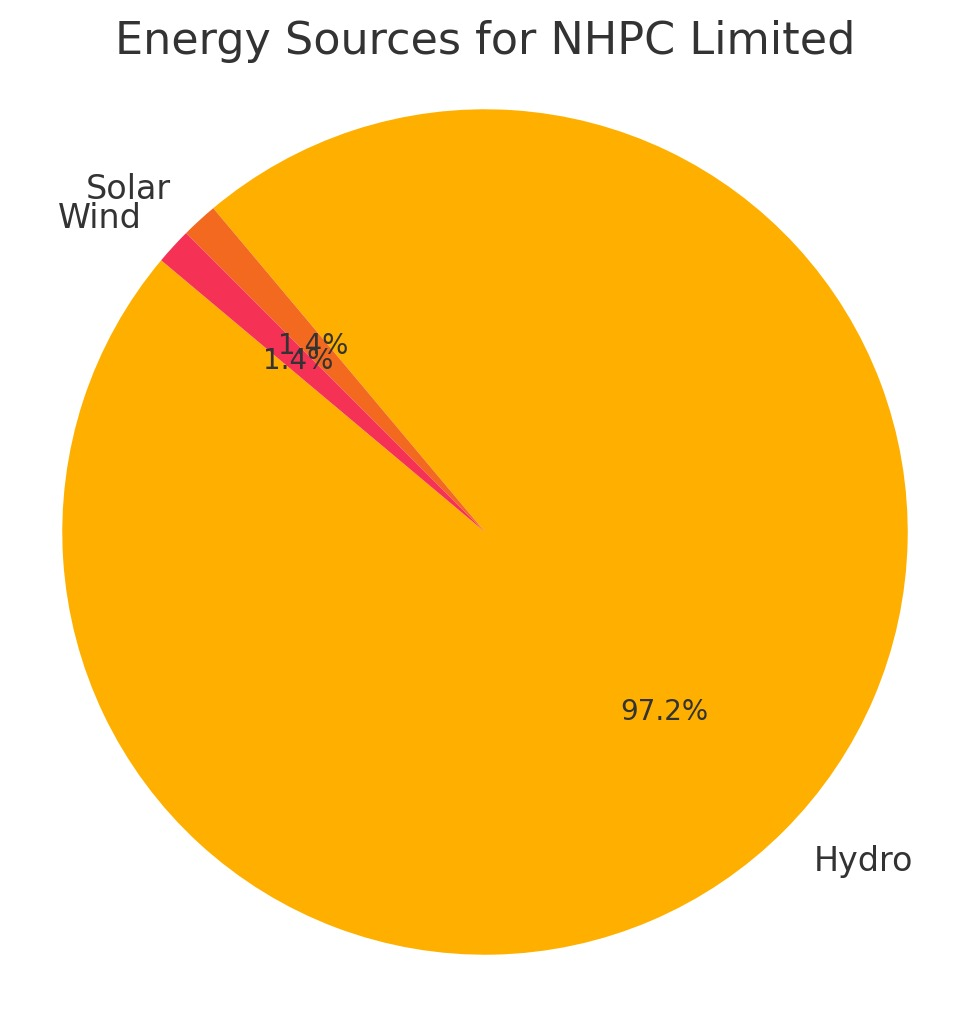

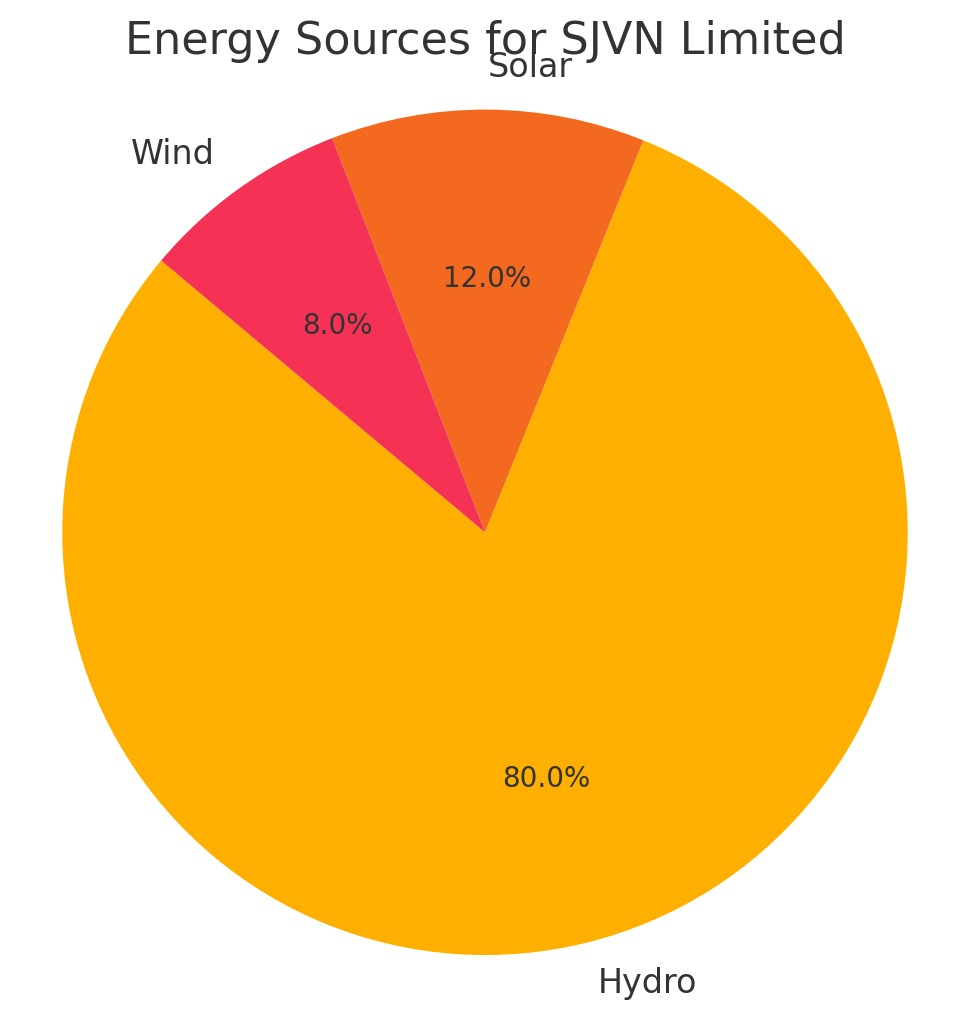

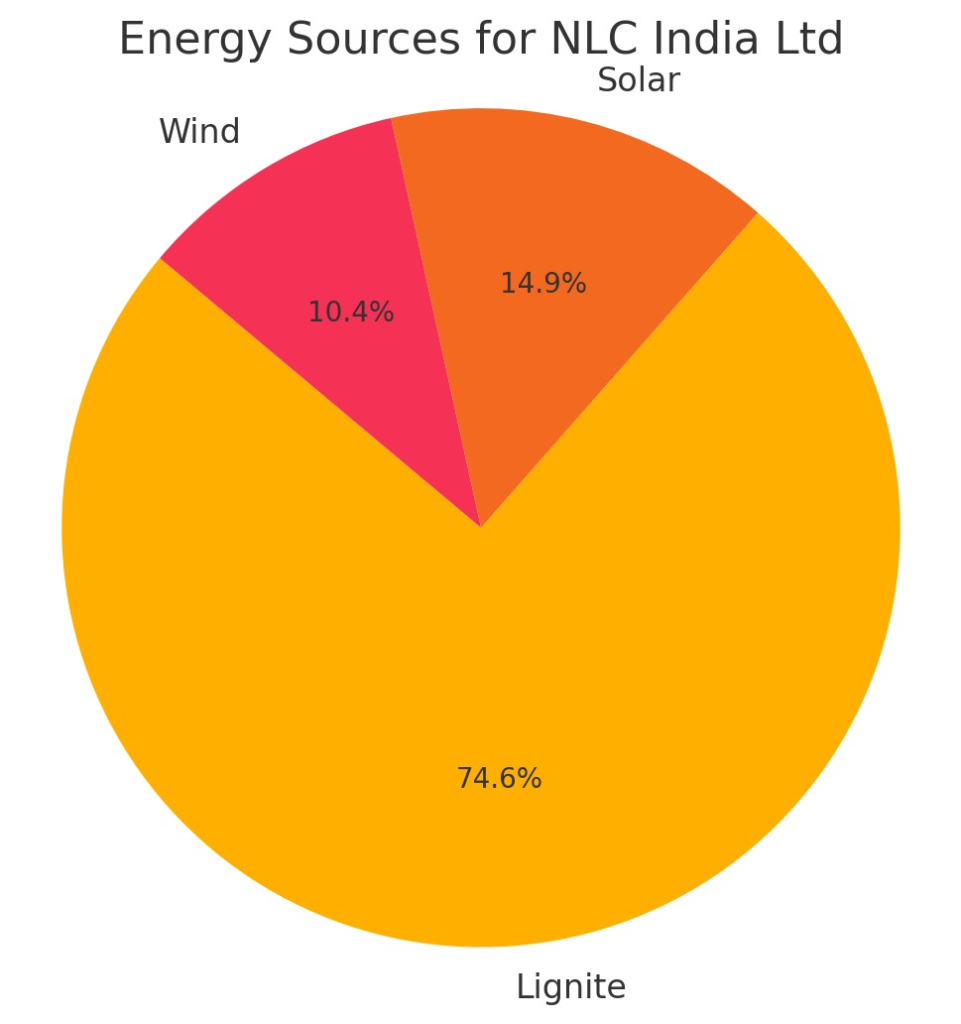

Understanding the type of business the market player operates in Power Sector is essential prior to investing to allocate investments in a manner that satisfies your risk capacity. Companies like NTPC, Adani Power Ltd.,Torrent Power, Tata Power, JSW Energy would be more impacted by change in coal prices as coal being their major source of energy generation. NLC being Lignite based, SJVN & NHPC being Hydro-based and Nuclear Power Corporation being Nuclear-based would be impacted by news relating to their major source .The power sector in India is experiencing a transformation, with PSU and private sector players aggressively investing in renewables to complement thermal power. Major players like NTPC, Adani Power, and Tata Power are not only expanding their renewable energy portfolios but are also setting ambitious targets to contribute to India’s goal of achieving 500 GW of renewable energy capacity by 2030. With decreasing capital costs in solar and wind energy, India is well-positioned to become a global leader in renewable energy production while ensuring a steady supply of thermal power to meet rising energy demand.

Disclaimer

This report has been prepared solely for informational purposes based on publicly available data and sources deemed reliable. The author has exercised reasonable care to ensure the accuracy of the data used; however, neither the author nor their organization guarantees the completeness or accuracy of this report and disclaims all liability for any loss or damage arising from its use. The author affirms that this report has been prepared independently, without any conflict of interest or financial compensation from any company or entity mentioned herein.

Data sources:

Central Electricity Authority.

Ministry of Power.

Ministry of Statistics and Programme Implementation (MOSPI).

The Press Information Bureau (PIB).

IBEF’s reports.

Finkhoz Platform

Company-specific information: sourced from annual presentations and official websites.